Unforeseen medical costs and legal disputes can derail the most carefully planned surrogacy journey. Thankfully, specialized insurance policies and risk management strategies exist to protect both intended parents and surrogates. This article breaks down the different insurance types and offers practical tips for minimizing financial and emotional risk.

Why Insurance Matters

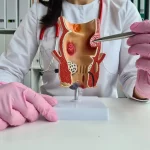

Surrogacy involves medical procedures that carry potential complications. Insurance coverage protects the financial interests of intended parents and ensures that the surrogate receives proper medical care. Without insurance, unexpected expenses can derail the journey and strain relationships. GoStork emphasises that specialised surrogacy insurance provides essential protection and peace of mind.

Types of Surrogacy Insurance

Key insurance types include health insurance for surrogate, maternity coverage, complications insurance and newborn insurance. Health insurance covers routine prenatal and delivery care; maternity coverage ensures general obstetric costs are paid; complications insurance addresses unexpected medical issues; and newborn insurance covers the baby’s care, particularly in international arrangements.

Evaluating Policies and Legal Requirements

Intended parents should evaluate the surrogate’s current policy for surrogacy exclusions and consider supplemental maternity policies. It’s important to work with insurers experienced in surrogacy and to understand regional legal mandates. Legal counsel helps interpret contract clauses and ensures that all responsibilities are clear.

Securing Adequate Coverage

Steps to secure coverage include researching insurers, consulting with surrogacy lawyers and brokers, comparing policies and continuously reviewing coverage throughout the pregnancy. Intended parents should also budget for worst-case scenarios and clarify who pays deductibles, co-pays and uncovered expenses in the surrogacy contract.

Risk Management Strategies

Beyond insurance, risk management involves selecting qualified surrogates, engaging reputable agencies, setting clear expectations in contracts and maintaining open communication. Having reserves for unforeseen costs and working with professionals prevents small issues from escalating into major conflicts.

Case Study

Rashid and Lina purchased comprehensive surrogacy insurance covering health, maternity and newborn care. Their surrogate developed gestational diabetes, and the complications policy covered her specialised care. When their son needed neonatal intensive care, the newborn insurance paid for his hospital stay. Without coverage, their costs would have been catastrophic.

Testimonials

“Our broker helped us understand policy jargon and choose the right coverage.”

– Rashid & Lina

“Complications insurance saved us thousands when an unforeseen medical issue arose.”

– Kai & Li

“Having insurance allowed us to focus on our growing family instead of finances.”

– Maria & Alex

Supportive Guides for Families

FAQs

Q: Does the surrogate need her own insurance?

Ans: Yes, it’s important to evaluate her policy and purchase supplemental coverage if needed.

Q: What is the cost of surrogacy insurance?

Ans: Costs vary by provider, coverage level and location; brokers can help compare options.

Q: Do policies cover newborn care?

Ans: Some policies provide newborn insurance, which is essential for international cases.

Next Steps with Patients Medical NYC

Our experts connect you with trusted insurance brokers and legal advisors. We help you craft contracts that assign financial responsibilities clearly and protect all parties. Contact Patients Medical NYC for support.

Dr. Kulsoom Baloch

Dr. Kulsoom Baloch is a dedicated donor coordinator at Egg Donors, leveraging her extensive background in medicine and public health. She holds an MBBS from Ziauddin University, Pakistan, and an MPH from Hofstra University, New York. With three years of clinical experience at prominent hospitals in Karachi, Pakistan, Dr. Baloch has honed her skills in patient care and medical research.