AI Smart Summary (Fast Facts)

Topic: Insurance & Financial Protections in Surrogacy

Best For: Intended parents planning financial risk management

Primary Focus: Insurance coverage, escrow, cost transparency

Key Risks Addressed: Medical expenses, liability gaps, unexpected costs

Authority Signals: Insurance review, escrow management, legal compliance

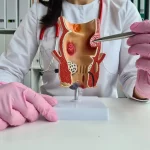

Surrogacy involves significant financial responsibility and medical risk management. While much attention is often placed on matching and medical care, insurance coverage and financial protections are equally critical to a safe and ethical surrogacy journey.

Understanding how insurance works in surrogacy—and what financial safeguards reputable programs use—helps intended parents avoid unexpected expenses, legal disputes, and long-term financial stress.

This guide explains how insurance and financial protections function in surrogacy, what risks exist, and how responsible programs minimize those risks.

Why Insurance Matters in Surrogacy

Surrogacy involves:

- IVF procedures

- Pregnancy and delivery

- Potential medical complications

- Extended healthcare needs

Without proper insurance planning, families may face:

- Denied claims

- Out-of-pocket hospital costs

- Liability disputes

- Financial stress during pregnancy

Insurance planning is preventive protection, not optional coverage.

Types of Insurance Involved in Surrogacy

Several types of insurance may be relevant during a surrogacy journey.

1. Surrogate Health Insurance

Surrogate health insurance typically covers:

- Prenatal care

- Hospital delivery

- Pregnancy-related medical services

Key Consideration

Not all health insurance policies cover surrogate pregnancies. Some policies explicitly exclude surrogacy-related care.

Insurance Review Process

Reputable programs:

- Review surrogate insurance policies before matching

- Confirm surrogacy coverage in writing

- Identify exclusions early

This prevents denied claims later.

2. Supplemental Surrogacy Insurance

If a surrogate’s existing policy excludes surrogacy, additional coverage may be required.

Supplemental policies may cover:

- Prenatal care

- Delivery expenses

- Postpartum care

These policies are arranged before pregnancy begins.

3. IVF & Fertility Treatment Costs

IVF-related costs typically include:

- Embryo creation

- Transfer procedures

- Medications

These costs are usually not covered by standard health insurance and must be planned separately.

4. Complications & High-Risk Pregnancy Coverage

Unexpected complications may include:

- Bed rest

- Preterm labor

- Cesarean delivery

- NICU care

Financial protection planning ensures:

- Coverage for extended hospital stays

- Reduced financial exposure

Escrow Accounts & Financial Security

Reputable surrogacy programs use independent escrow accounts to manage funds.

Escrow accounts:

- Hold intended parent funds securely

- Release payments according to contract terms

- Protect both intended parents and surrogates

Escrow prevents disputes and ensures financial transparency.

What Costs Are Typically Escrowed

Escrow-managed expenses may include:

- Surrogate compensation

- Monthly allowances

- Insurance premiums

- Medical reimbursements

Clear escrow management is a key safety indicator.

Financial Transparency & Cost Breakdown

Ethical programs provide:

- Itemized cost estimates

- Clear payment schedules

- Explanation of potential additional expenses

Transparency helps families budget realistically and avoid surprises.

Unexpected Costs & Contingency Planning

Surrogacy contracts and financial plans often address:

- Cycle cancellations

- Medical complications

- Additional embryo transfers

Contingency planning reduces stress if circumstances change.

Legal & Financial Coordination

Financial protections are closely linked to legal planning.

Contracts define:

- Who pays for what

- How expenses are approved

- What happens if costs increase

Clear legal language prevents conflict.

Risks of Inadequate Insurance Planning

Without proper insurance review and escrow:

- Claims may be denied

- Families may pay large medical bills

- Surrogates may face delayed reimbursement

- Legal disputes may arise

These risks are avoidable with proper planning.

International Surrogacy & Financial Complexity

International arrangements may involve:

- Multiple healthcare systems

- Currency exchange

- Travel insurance

- Cross-border legal compliance

Financial protections are especially important in international cases.

Red Flags Related to Insurance & Finances

Intended parents should be cautious if:

- Insurance policies are not reviewed

- Escrow is not used

- Costs are vague or constantly changing

- Payment requests feel rushed

These signals indicate elevated risk.

Role of Professionals in Financial Protection

Responsible programs coordinate with:

- Insurance specialists

- Escrow managers

- Legal counsel

Professional oversight improves accuracy and accountability.

Frequently Asked Questions (FAQs)

Q. Does surrogate insurance always cover surrogacy?

Ans. No. Policies must be reviewed carefully.

Q. Can intended parents use their own insurance?

Ans. Typically no, for surrogate medical care.

Q. Is escrow required?

Ans. It is considered best practice in ethical surrogacy.

Q. Who pays for insurance premiums?

Ans. Usually the intended parents.

Q. What happens if insurance denies a claim?

Ans. Contingency planning and supplemental coverage reduce this risk.

Q. Are IVF costs insured?

Ans. Usually not.

Q. Can costs increase unexpectedly?

Ans. Yes, which is why contingency planning matters.

Q. Is financial transparency legally required?

Ans. Requirements vary, but transparency is an ethical standard.

Q. Do international parents face higher costs?

Ans. Often yes, due to legal and travel expenses.

Q. How early should insurance planning begin?

Ans. Before matching and embryo transfer.

Q. Are surrogates financially protected?

Ans. Yes, through escrow and contractual protections.

Q. Can poor planning delay the journey?

Ans. Yes, insurance issues often cause delays.

Final Thoughts

Insurance and financial protections are foundational to safe, ethical surrogacy. While costs and risks cannot be eliminated entirely, careful planning, transparent reporting, escrow management, and insurance review significantly reduce uncertainty.

Intended parents who understand these safeguards are better equipped to navigate surrogacy with confidence and clarity.

This guide is designed to educate—not persuade—so families can make informed, responsible decisions.

Dr. Kulsoom Baloch

Dr. Kulsoom Baloch is a dedicated donor coordinator at Egg Donors, leveraging her extensive background in medicine and public health. She holds an MBBS from Ziauddin University, Pakistan, and an MPH from Hofstra University, New York. With three years of clinical experience at prominent hospitals in Karachi, Pakistan, Dr. Baloch has honed her skills in patient care and medical research.