Key Takeaways

- Insurance coverage in surrogacy varies depending on carrier, surrogate, and state regulations.

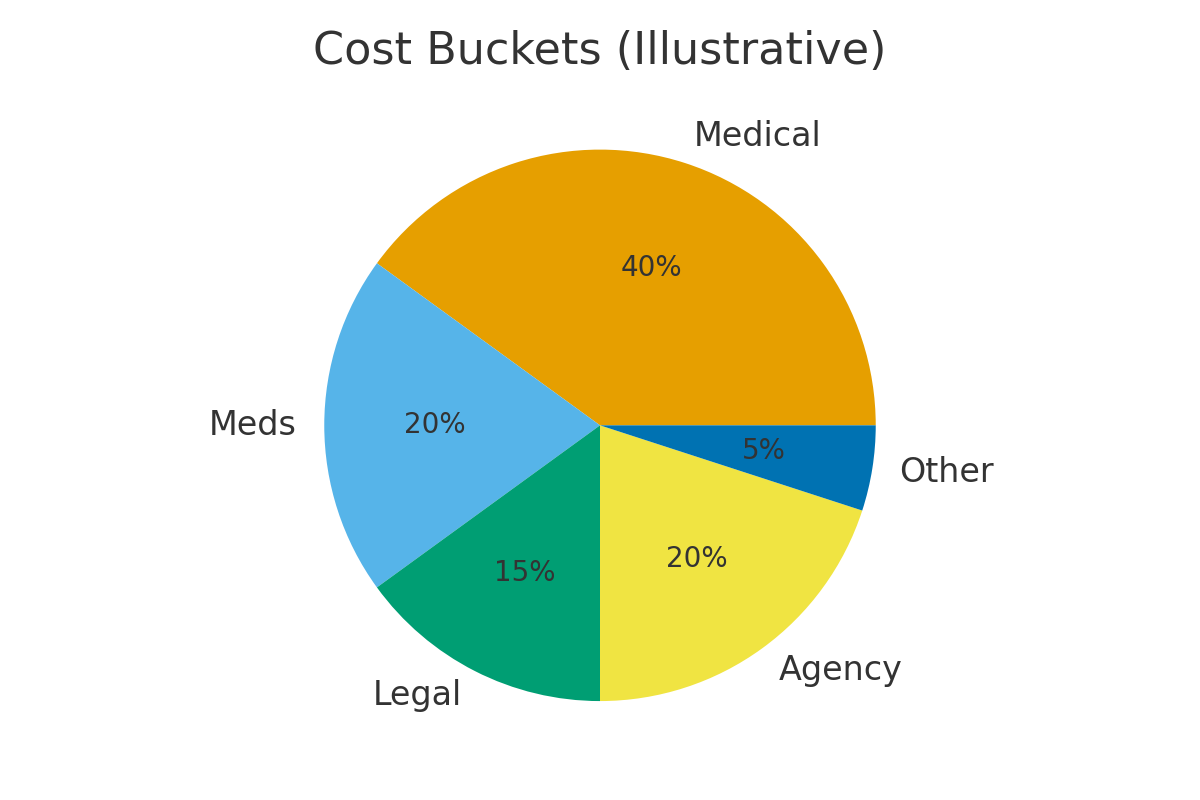

- Out-of-pocket costs may include medications, monitoring, legal fees, and complications not covered by insurance.

- An insurance estimator helps surrogates and intended parents anticipate and plan for these expenses.

- Using this tool improves transparency, reduces surprises, and enhances financial planning.

- Understanding insurance limitations helps align expectations between surrogates and intended parents.

Surrogacy involves multiple medical procedures, legal contracts, and potential complications. Insurance coverage is a crucial piece of the puzzle, but it can be confusing to determine what is covered and what requires out-of-pocket payments.

The Insurance Coverage Estimator is a tool designed to clarify these uncertainties. By entering plan details, expected medical procedures, and potential complications, intended parents and surrogates can see realistic out-of-pocket scenarios. This empowers families to plan ahead, avoid surprises, and focus on the journey rather than financial stress.

How Insurance Coverage Works in Surrogacy

Insurance coverage for surrogacy typically depends on three key factors:

Surrogate’s Health Insurance

Most carriers provide maternity coverage for the surrogate, but exclusions may apply for IVF, egg donation, or surrogacy-related complications.

Intended Parents’ Insurance

Intended parents may have coverage for embryo creation, medications, or pre-existing conditions, but coverage varies widely by policy.

State and Legal Considerations

Some states require certain coverage levels for surrogacy procedures, while others have no mandates. Legal contracts often specify financial responsibility for uncovered procedures.

How the Insurance Coverage Estimator Works

The tool calculates potential out-of-pocket costs by:

Step 1: Input Insurance Details

Enter plan type, deductibles, copays, and covered procedures.

Step 2: Add Expected Procedures

Include IVF cycles, embryo transfers, medications, monitoring, and potential complications.

Step 3: Factor Contingency Scenarios

Add possible emergency costs, additional cycles, or hospitalization events.

Step 4: Generate Estimated Out-of-Pocket Costs

The estimator calculates minimum, average, and maximum expenses you may pay personally. It provides a clear financial snapshot for better planning.

Why This Tool Matters

- Transparency: Understand what insurance covers and what it doesn’t.

- Budget Planning: Align finances for the entire surrogacy journey.

- Decision-Making: Determine whether a particular surrogate or clinic aligns with coverage needs.

- Contingency Preparation: Allocate funds for unexpected complications or additional procedures.

Case Study

Patient: Meera & Rohit, Intended Parents

Scenario: First surrogacy cycle using a gestational carrier.

Inputs:

- Surrogate insurance: maternity coverage only

- IVF coverage: partial through intended parents’ insurance

- Expected procedures: 1 IVF cycle, 2 embryo transfers, medications

- Contingency: emergency hospital stay

Estimator Result:

-

Estimated out-of-pocket: $18,500 – $25,000 depending on hospital and medication costs

Outcome: Meera & Rohit were able to secure funds in advance and choose a clinic that maximized insurance coverage, reducing financial stress.

Testimonials

Priya, Intended Parent

“The estimator made insurance coverage clear. We knew exactly how much we needed to save before starting the surrogacy process.”

Michael, Gestational Surrogate

“Seeing potential out-of-pocket costs upfront helped me plan travel and monitor appointments without worrying about surprises.”

Lina, Surrogacy Coordinator

“This tool allows surrogates and intended parents to make informed financial decisions while minimizing risk.”

Expert Quote

“Understanding insurance coverage is essential in surrogacy. An estimator allows families to anticipate out-of-pocket costs and plan accordingly, improving both financial and emotional readiness.”

— Dr. Kavya Menon, Reproductive Finance Consultant

Rlated links

Glossary

- Out-of-Pocket Costs: Expenses not covered by insurance.

- Deductible: Amount paid by the insured before insurance coverage applies.

- Copay/Coinsurance: Portion of costs shared by insured and insurer.

- IVF Cycle: Complete egg retrieval, fertilization, and embryo transfer process.

- Gestational Carrier: Surrogate carrying a pregnancy for intended parents.

- Contingency Fund: Reserved funds for emergencies or unexpected medical expenses.

- Coverage Exclusion: Services or procedures not covered by insurance.

FAQs

Q. What does the Insurance Coverage Estimator do?

Ans : It calculates potential out-of-pocket costs by analyzing insurance coverage, expected procedures, and contingency scenarios during surrogacy.

Q. Who should use this tool?

Ans : Intended parents and gestational surrogates can use the tool to anticipate financial responsibilities and plan accordingly.

Q. Does the estimator guarantee costs?

Ans : No. The tool provides estimates based on inputted coverage and procedures; actual costs may vary depending on hospital, clinic, and unforeseen medical events.

Q. Can the estimator handle multiple IVF cycles?

Ans : Yes. Users can enter multiple cycles to see cumulative out-of-pocket expenses.

Q. Does it account for emergency hospitalizations?

Ans : Yes, contingency scenarios such as hospitalization can be added to estimate maximum potential expenses.

Q. Can surrogates input their own insurance plan?

Ans : Yes. Surrogates can enter their maternity or medical insurance details to see which costs are covered.

Q. Are medications included?

Ans : Yes. IVF medications, hormone therapies, and related prescriptions can be included in the estimator.

Q. Does it work for international surrogacy?

Ans : Yes. Users can input local currency, clinic fees, and insurance information for international programs.

Q. How does this tool help with financial planning?

Ans : By forecasting potential out-of-pocket expenses, it allows families to allocate funds, reduce financial stress, and make informed decisions before starting surrogacy.

Q. Can intended parents and surrogates share results?

Ans : Yes. Shared estimates improve transparency, build trust, and reduce miscommunication.

Q. Does the tool consider insurance deductibles?

Ans : Yes, deductible amounts are used to calculate when coverage begins, affecting out-of-pocket estimates.

Q. How often should the estimator be updated?

Ans : Whenever insurance plans, IVF procedures, or travel/medical needs change, the estimator should be updated to ensure accurate cost forecasting.

Plan your surrogacy journey with confidence using our Insurance Coverage Estimator. Anticipate out-of-pocket costs and budget effectively for IVF, surrogacy, and embryo transfer procedures.

Or help families grow:

👉 Become a Gestational Surrogate – Join Our Community at Surrogacy.com

Dr. Kulsoom Baloch

Dr. Kulsoom Baloch is a dedicated donor coordinator at Egg Donors, leveraging her extensive background in medicine and public health. She holds an MBBS from Ziauddin University, Pakistan, and an MPH from Hofstra University, New York. With three years of clinical experience at prominent hospitals in Karachi, Pakistan, Dr. Baloch has honed her skills in patient care and medical research.